Author: Wendy Burton

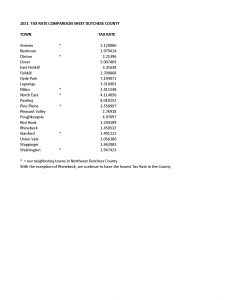

An Explanation of your 2021 Tax Bill

I am deeply sorry that there continues to be so much confusion about our 2021 tax bills. To explain as simply as I can, the reason the tax levy increase appears on your tax bill as 175% harkens back to the 60% cut that was done in 2020 when the prior administration changed the levy after losing the election. The Town only received $418,000 in Real Property Taxes last year for the entire year. The Highway alone was supposed to receive just shy of $1 million.. The General Fund received no financing at all.

When we prepared the 2021 Budget, after shaving off as much fat as we thought prudent, we used our 2019 taxes as a basis from which to work. Using 2020 was absolutely non-sustainable. You can’t maintain a town with 60% tax cuts year after year.

The taxes did go up. If you compare them to the benchmark year that we said we would use [2019], the tax hike is quite small. If you compare them to the tax bill you received in 2020, after the levy was cut by 60% by the outgoing administration, the difference is considerable. It was predicted at a December 2019 Town Board meeting that a Democratic administration would raise taxes, which was an ironic self-fulfilling prophecy. Both the citizens of Stanford and my administration were set up so this would happen. We have worked diligently on the Town finances. We have corrected accounting errors that date back to 2016 which significantly impacted our balance sheets. We are poised to move forward now, and hope to be able to enter 2022 without raising taxes at all. I can’t promise that. We will need to see how the year unfolds, but it is a real goal.

If your taxes in 2019 were hypothetically $100 and the levy was cut by 60%, your taxes would have been $40.00 for 2020. If we had raised taxes for 2021 by 60%, that would have been an additional $24.00, $64.00 in total. EVEN at 175%, your taxes would be $70.00 which means we did not make up the entire deficit that the TAX CUT created. When we used our 2019 taxes as a base line, the increase was about 8.5%, which has given us a solid foundation for Budgets moving forward. Please look at your 2019 tax bill and if you have questions, call me directly at 868 1310 option 2. I’ll be happy to explain as best as I can.

Winter Photography Contest has begun!

https://www.townofstanfordphotocontest.org/home/#contest Scroll down to the bottom of the page to enter the Winter Contest.

Town Hall Closed February 1st due to Nor’Easter

Due to predictions of strong winds and heavy snowfall, Town Hall will be closed on Monday. If you have an emergency, please call 911.

Many of use will be working remotely from home so you can still email us with questions or problems.

We will decide tonight whether we need to close Town Hall tomorrow as well.

The emergency phone number for Central Hudson is 845 452 2700. Please stay safe.

County Executive Marc Molinaro to join our Feb 11th Town Board Zoom Meeting

Please join our Zoom meeting at 7:00 on Feb 11th [enter from portal on the Town Website Home Page]. Marc will discuss the benefits of becoming a Climate Smart Community [nothing scary involved] and will answer questions. I am so very pleased to be working with our County Executive so we can become educated on this program.

Claire Eskdale Winner of our First Photography Contest !

Congratulations to the five winners of our First Stanford Photography Contest.

Claire Eskdale, First Place with Untitled

Frank Sellenberg, Second Place with One of Nature’s Gifts

and tied for Third Place, Curtis DeVito with Sunset after a Storm , Nancy Kryzak with Autumn in New York and Josh Nathanson with Buttercup Audubon Preserve